Bill Mitchell, an insightful heterodox economist from Australia, points out:

"... a defining characteristic of the neo-liberal period has been the fall in the wage share in national income in most nations. This has come about because real wages growth has dragged behind productivity growth. The gap between the two represents profits and shows that during the neo-liberal years there was a dramatic redistribution of national income towards capital.

This has been aided and abetted by governments in a number of ways: privatisation; outsourcing; pernicious welfare-to-work and industrial relations legislation (designed to reduce the capacity of trade unions); etc to name just a few of the ways. These ways vary by country.

The problem that arises is if the output per unit of labour input (labour productivity) is rising so strongly yet the capacity to purchase (the real wage) is lagging badly behind – how does economic growth which relies on growth in spending sustain itself?"[Note: You should first understand is that Mitchell's use of the term 'neo-liberal' is not AT ALL what the casual American reader might assume in knee-jerk reaction to the 'liberal' part of the term. In fact, outside the U.S., the term 'neo-liberal' is essentially what is known as right-wing movement conservatism (with a few American idiosyncracies thrown in)... 180-degrees opposite of what most non-academic Americans understand as 'liberal'.]

The short answer to the highlighted question is, of course, that economic growth will not and cannot be sustained... if we continue on the path of increasingly conservative economic policies that the U.S. has been on for the last 30+ years [basically, since Reagan].

Mitchell provides some detail:

In the past, the dilemma of capitalism was that the firms had to keep real wages growing in line with productivity to ensure that the consumption goods produced were sold. But in the lead up to the crisis, capital found a new way to accomplish this which allowed them to suppress real wages growth and pocket increasing shares of the national income produced as profits. Along the way, this munificence also manifested as the ridiculous executive pay deals and Wall Street gambling that we read about constantly over the last decade or so and ultimately blew up in our faces.

The trick was found in the rise of “financial engineering” which pushed ever increasing debt onto the household sector. The capitalists found that they could sustain purchasing power and receive a bonus along the way in the form of interest payments. This seemed to be a much better strategy than paying higher real wages.

The household sector, already squeezed for liquidity by the move to build increasing federal surpluses were enticed by the lower interest rates and the vehement marketing strategies of the financial engineers.

The financial planning industry fell prey to the urgency of capital to push as much debt as possible to as many people as possible to ensure the “profit gap” grew and the output was sold. And greed got the better of the industry as they sought to broaden the debt base. Riskier loans were created and eventually the relationship between capacity to pay and the size of the loan was stretched beyond any reasonable limit. This is the origins of the sub-prime crisis.

So the dynamic that got us into the crisis is present again and with fiscal austerity emerging as the key policy direction the welfare of our economies is severely threatened. This is a dramatic failure of government oversight..."

Bill references a UN-sponsored economic report that sheds even more light:

These dynamics are clearly outlined in the recent UNCTAD Trade and Development Report, 2011. Its depiction of root causes of the current economic problems could not be clearer:

The pace of global recovery has been slowing down in 2011 … In many developed countries, the slowdown may even be accentuated in the course of the year as a result of government policies aimed at reducing public budget deficits or current-account deficits. In most developing countries, growth dynamics are still much stronger, driven mainly by domestic demand.

As the initial impulses from inventory cycles and fiscal stimulus programmes have gradually disappeared since mid-2010, they have revealed a fundamental weakness in the recovery process in developed economies. Private demand alone is not strong enough to maintain the momentum of recovery; domestic consumption remains weak owing to persistently high unemployment and slow or stagnant wage growth. Moreover, household indebtedness in several countries continues to be high, and banks are reluctant to provide new financing. In this situation, the shift towards fiscal and monetary tightening risks creating a prolonged period of mediocre growth, if not outright contraction, in developed economies.They also highlight distributional issues which are usually suppressed by the conservatives in the public debate but should be at centre-stage.

Wage income is the main driver of domestic demand in developed and emerging market economies. Therefore, wage growth is essential to recovery and sustainable growth. However, in most developed countries, the chances of wage growth contributing significantly to, or leading, the recovery are slim. Worse still, in addition to the risks inherent in premature fiscal consolidation, there is a heightened threat in many countries that downward pressure on wages may be accentuated, which would further dampen private consumption expenditure. In many developing and emerging market economies, particularly China, the recovery has been driven by rising wages and social transfers, with a concomitant expansion of domestic demand …

Wage growth that is falling short of productivity growth implies that domestic demand is growing at a slower rate than potential supply. The emerging gap can be temporarily filled by relying on external demand or by stimulating domestic demand through credit easing and raising of asset prices. The global crisis has shown that neither solution is sustainable. The simultaneous pursuit of export-led growth strategies by many countries implies a race to the bottom with regard to wages, and has a deflationary bias. Moreover, if one country succeeds in generating a trade surplus, this implies that there will be trade deficits in other countries, causing trade imbalances and foreign indebtedness. If, on the other hand, overspending is enticed by easy credit and higher asset prices, as in the United States before the crisis, the bubble will burst at some point, with serious consequences for both the financial and real economy. Therefore, it is important that measures be taken to halt and reverse the unsustainable trends in income distribution.

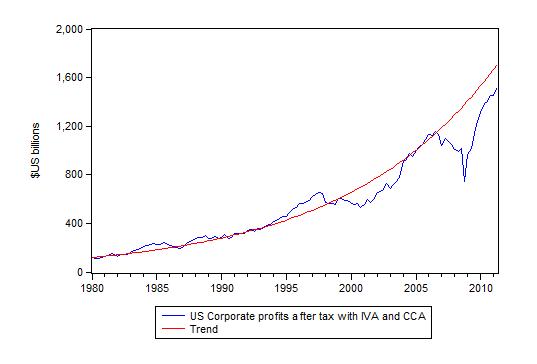

Mitchell discovers more evidence to support his thesis from data provided by the St. Louis Fed:

... in the early stages of the crisis corporate profits slumped as growth came to a halt and you can see the impact of that in both the following graph and also in the rise in the wage share in the graph presented earlier. But as growth has resumed, the corporate profits series has nearly returned to trend while the wage share continues to fall.

In other words, what growth there has been since the downturn has been largely captured by capital. Workers have not shared in that growth much at all which explains why consumption is so subdued. The subdued consumption, in turn, reduces the incentive by firms to invest and so they are “cashed up” more than usual at present.

The major redistribution of national income over the neo-liberal period has been the source of funding for the dramatic expansion of the now (over-sized) financial sector. The reality is that much of the redistributed real income did not return as investment spending but was rather used to buy the gambling chips that the financial sector gambled with.

There will be massive resistance from that sector to government attempts at re-regulation and redistribution of national income back to workers.

The UNCTAD Trade and Development Report is also insightful when it comes to dealing with the financial markets:

Those who support fiscal tightening argue that it is indispensable for restoring the confidence of financial markets, which is perceived as key to economic recovery. This is despite the almost universal recognition that the crisis was the result of financial market failure in the first place. It suggests that little has been learned about placing too much confidence in the judgement of financial market participants, including rating agencies, concerning the macroeconomic situation and the appropriateness of macroeconomic policies. In light of the irresponsible behaviour of many private financial market actors in the run-up to the crisis, and costly government intervention to prevent the collapse of the financial system, it is surprising that a large segment of public opinion and many policymakers are once again putting their trust in those same institutions to judge what constitutes correct macroeconomic management and sound public finances.And on the need for fiscal policy to support a process of national income redistribution back to workers, the UNCTAD report also has sound advice:

… there is a widespread perception that the space for continued fiscal stimulus is already – or will soon be – exhausted … There is also a perception that in a number of countries debt ratios have reached, or are approaching, a level beyond which fiscal solvency is at risk.

However, fiscal space is a largely endogenous variable. A proactive fiscal policy will affect the fiscal balance by altering the macroeconomic situation through its impact on private sector incomes and the taxes perceived from those incomes. From a dynamic macroeconomic perspective, an appropriate expansionary fiscal policy can boost demand when private demand has been paralysed due to uncertainty about future income prospects and an unwillingness or inability on the part of private consumers and investors to incur debt.

In such a situation, a restrictive fiscal policy aimed at budget consolidation or reducing the public debt is unlikely to succeed, because a national economy does not function in the same way as an individual firm or household. The latter may be able to increase savings by cutting back spending because such a cutback does not affect its revenues. However, fiscal retrenchment, owing to its negative impact on aggregate demand and the tax base, will lead to lower fiscal revenues and therefore hamper fiscal consolidation … Moreover, making balanced budgets or low public debt an end in itself can be detrimental to achieving other goals of economic policy, namely high employment and socially acceptable income distribution.These are all words that can speak for themselves with no further prompting or intervention from yours truly.

No comments:

Post a Comment