Why ‘Occupy Wall Street’ Makes Sense: Lessons Economists Could Learn from the 99% Steve Keen's Debtwatch

Joe McIvor, guest-blogging over at Steve Keen's DebtWatch, expresses my thoughts exactly (and with far fewer parentheses, brackets, curliqueues, hyphens and similar stream of consciousness tangents):

____________________________________________________________

Why ‘Occupy Wall Street’ Makes Sense: Lessons Economists Could Learn from the 99%

by

antifriedmanitejoeon October 25th, 2011 at 10:54 pm

Posted In:

Debtwatch(guest blog) by Joe Mcivor

Back in May of this year, Austin Mackell wrote in

The Guardian that the Arab Spring revolutions represented “a rebellion not just against local dictators, but against the global neoliberal programme they were implementing with such gusto in their countries”. He cited Egypt in particular as an example of a nation which had taken IMF loans and then promptly implemented their recommendations of substantial privatisation and cutting of services, with the usual disastrous results for the well-being of the population. He went on to write that people in the West had so far “failed to see the people of the region as natural allies in a common struggle”.

Some six weeks ago, thousands of people in New York began to try to correct this oversight. Drawing explicit inspiration from the Arab Spring, a Canadian activist group called

Adbusters (self-described ‘culture jammers’ involved in exposing corporate wrongdoing and highlighting the problems of consumerism and advertising) called on people in New York to

Occupy Wall Street, in an attempt to highlight what they see as the destructive excesses of a financial sector not only out of control but propped up by governments who frequently grant them disproportionate privileges.

The ‘Occupation’ (which didn’t last long on actual Wall Street but remains in surrounding areas) drew thousands of protesters using the slogan ‘We Are the 99%’, highlighting the increasing proportion of wealth going to a small proportion of the population. The ‘Occupy’ brand has now spread throughout the world, with the now even more invigorated European austerity protests expressing solidarity with their American counterparts. Even in Australia, so far mostly unscathed by the ravages of the Global Financial Crisis (though this is likely to soon change), but nonetheless suffering from overpriced housing, unprecedented household debt levels and increasingly insecure employment prospects, protests using the Occupy brand are occurring (and Steve [Keen, Associate Professor of Economics & Finance at the University of Western Sydney] was naturally asked to speak at one such protest in Sydney).

The ‘common struggle’, it would seem, has begun.

The purpose of this guest blog entry won’t be to detail the exploits of the protesters since this all began – for this you can check out

democracynow.org for their excellent coverage. Nor will this blog be as rigorous in discussing theory as Steve’s blogs often have been: there won’t be a detailed discussion of endogenous money, or Minsky’s ‘financial instability hypothesis’ [1]. However, in considering the sentiments expressed by the protest movement it occurred to me how often people uneducated in economic theory of any kind, when confronted with the reality of an economic problem, instinctively, intuitively understand the problem and its causes more or less correctly; while economists, who purport to specialise in the area of economic problems (and, it must be said, seem to go out of their way to be counterintuitive), get it fundamentally wrong. Below, I outline why, in a number of areas, economists could learn from the intuitive wisdom of the 99%.

Lesson #1. Unbridled Greed isn’t Good.The ‘greed is good’ (ie ‘the invisible hand’) idea – that unregulated markets would maximise societal benefit by the heedless pursuit by individuals and corporations of their own self-interests, while government should restrict both its regulatory and fiscal role in the economy as much as possible – should have died out in the wake of the Great Depression. Unfortunately for most of us, Milton Friedman then came along with an explanation for the depression more palatable to the neoclassical mindset than what had come previously. Along with Anna Schwartz, he argued that the Great Depression wasn’t caused by unbridled greed and speculation: it was caused by the Federal Reserve (essentially) not printing enough money and giving it to Wall Street. Yes, really. If the Fed had printed more money and given it to Wall Street, they argued, this would have restored banking confidence and Wall Street would have resumed lending and prevented the worst of the depression – greed would have saved the day [2]. Unbridled greed was now off the hook for what was seen as the worst economic crisis in capitalism’s history.

When the highly sanitised and compromised version of Keynesian theory, which neoclassical economists had initially come to accept as a way of coming to grips with the Depression (without the revolution in economic thinking which Keynesian theory actuallly implied) [3], ultimately couldn’t explain stagflation, this allowed Friedman to step in and successfully argue (despite an absence of any actual evidence) that stagflation was caused by excessive government spending funded by new fiat money creation. Friedman emerged as the new economic messiah, and a new consensus (which was a lot like the old consensus from before the depression) emerged in economics. This consensus had a number of central tenets:

1 - Greed is good and must be left unhindered by regulation which distorts the beneficial effects of greed.

2 - The central bank can and should control inflation (or prevent deflation as the case may be) by means of fiat control of the money supply, and focus on nothing else. The system is basically stable and as long as the central bank does its job little or no harm should come to the economy as a whole.

3 - Fiat money creation to provide liquidity to the financial sector is good and productive; while fiat money creation to pay for fiscal spending on things like social security, health care, education etc is bad, unproductive and causes unnecessary inflation.

4 - Related to 3, government should be frugal, privatise more of its functions, and cut services generally. Private enterprise, because it is driven by greed, is always better at meeting people’s needs than government, which is woefully inefficient. The government should also cut taxes, especially on the rich, who by their greedy actions are the drivers of economic prosperity for everyone.

5 - Government debt is a sign of poor economic management. Private enterprise and individuals on the other hand must spend, spend, spend and private debt is either unimportant or a sign of progress.

6- Inequality doesn’t matter. The rich may get proportionally richer, but their pursuit of wealth lifts everyone up with them.

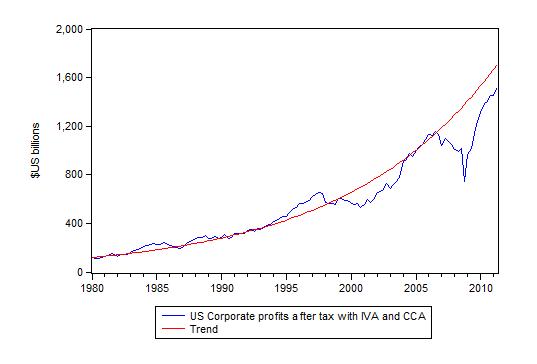

These theories have become more or less the state of the art in economic thinking, and have been adopted to varying degrees as policy throughout much of the world – most famously in the U.S. under Reagan and the UK under Thatcher. Even before the GFC, though, the results for the majority of citizens were less than stellar. Strangely enough, the beginnings of the implementation of some of Friedman’s theories in the 1980s resulted immediately in what was then the deepest recession since the Great Depression in terms of unemployment in the U.S., but the agenda was pressed forward with the contention that in the long term things would be better. Even before the GFC, the decades since in the U.S. saw stagnant real wages [4], a declining real value of the minimum wage, reduced access to health care (and a higher cost for those with access), increasingly precarious employment, a decimated manufacturing sector, and skyrocketing levels of private debt. The gains in GDP were not shared – did not ‘trickle down’ – but were wholly appropriated by a small minority of the highly paid. Economists, meanwhile, were claiming victory over the problem of economics and economic stability, and spoke of the ‘great moderation’.

Many of this minority of the highly paid were in the financial sector, which engaged in increasingly risky credit behaviour in order to reap higher profits, confident in the knowledge that the Fed would bail them out if they got into trouble. Now, as has been discussed many times on this blog, the debt-driven speculative excesses of the financial sector have resulted in the worst economic calamity since the Great Depression. Their interest in profiting from the proliferation of credit, and their increasing reliance on debt-financed asset price speculation rather than investment in genuinely productive enterprise, inevitably (as Steve Keen predicted) caused a system wide collapse. So many people got into so much debt that they couldn’t afford to service (much less repay) that it reached a saturation point, asset prices stopped increasing, and a process of deleveraging began as people stopped borrowing or even tried to pay down debt. An economy dependent upon expanding debt – as Steve has shown at least the

U.S. and

Australia to have become – ultimately can’t survive a deleveraging process unscathed (though the deleveraging process hasn’t yet begun in earnest in the latter country). As money is spent on paying down debt, or even if people simply don’t continue to borrow ever more, there isn’t enough money being spent on actual goods and services to keep the economy afloat. In the U.S., official unemployment (U3) has been hovering in the 9-10 percent range since 2009 or so, with the more inclusive (and comparable to Depression-era figures) U6 measure roughly in the 16-17% range for the same period, and this has occurred in spite of Bernanke’s adoption of the Friedman solution through unprecedented base money expansion and bailouts of the Wall Street firms who helped precipitate the crisis. Meanwhile, executives of firms which took massive government hand-outs after helping to precipitate the crisis are still taking bonuses for their trouble.

According to economic theory, none of this should be happening because the system is basically stable, the financial sector are more or less omniscient drivers of economic progress, private debt doesn’t matter, and the central bank can prevent economic meltdown with helicopter drops of money. Some economists are probably still burying their heads in the sand and saying it’s NOT happening. On the other hand, the 99% are all too aware of what is happening, and have a pretty good sense of why. While perhaps not fully understanding Minsky’s ‘Financial Instability Hypothesis’ or Steve Keen’s formal modeling of it, they do at least understand that too much private debt is a bad thing, and that the system is simply not inherently stable. They also understand that unbridled greed is really only good for the greedy.

Lesson # 2. The Problem is not the SolutionThere now at least seems to be some understanding among policymakers that Wall Street’s excesses played an important role in creating the crisis (though Big Government is still partly being made a scapegoat). It seems strange, then (and, once again, counterintuitive), that the principal means by which policymakers in the U.S. propose to get out of the crisis is by trying to ‘get banks lending again’. The solution is essentially more Wall Street, more private debt.

Of course, it must be acknowledged that this has ‘worked’ – or at least appeared to work – a number of times in the past. Starting with the 1987 crisis, Alan Greenspan (himself a staunch Friedmanite) responded to successive crises with cheaper money and bailouts for the financial sector. At least partly, it ‘worked’: lending was restarted, and, though frequent, the economic crises during his reign seemed relatively mild.

Never mind that some of the engineered recoveries were ‘jobless’: Greenspan was hailed as a hero. His successor Ben Bernanke, again an avowed Friedmanite, believed that this policy would continue to avert major crises indefinitely.

Even in the wake of the crisis, the Obama administration has been convinced by economists that each dollar spent on monetary stimulus for the financial sector will result in many times that in lending for private consumption and investment through the magic of the multiplier effect in the fractional reserve system.

There are two problems with this. One is that it has probably reached a point (at least in the U.S.) where it simply won’t work any more. The premise is that if you expand base money you’ll get many times that amount in extra lending – the Fed’s control of fiat money gives it effective control of the broad money supply because the ratio between the monetary base and the money supply is assumed to be relatively stable. Unfortunately this ignores the fact that the extra (private) lending which is supposed to make up the bulk of that monetary stimulus is dependent upon the decisions of lenders to lend and borrowers to borrow (the money supply endogeneity Steve so often emphasises).

These decisions are dependent on a range of factors, of which the availability and cost of fiat money from the central bank is but one. In the past, cheap money was enough to get lending happening again. But with debt levels having reached such a high saturation point, and with economic expectations uncertain at best, making money cheap for the banks and expanding the monetary base (the Friedman/Greenspan/Bernanke solution) simply won’t be enough to restart lending: people don’t want to borrow and banks don’t want to lend. Bernanke’s ‘helicopter drop’ of money is effectively sitting in bank vaults doing very little for the economy. In the decades leading up to the crisis , excess bank reserves represented a fraction of a percent of the money supply (M2). They now account for around 16% [5].

The second problem is that restarting lending doesn’t actually fix the problem: it just defers the consequences while simultaneously facilitating the exacerbation of the core cause ( too much private debt). In fact, it amounts to trying to solve a problem of excessive debt by encouraging even more debt. This is what has happened in this case: Greenspan’s recoveries facilitated an accelerated rate of growth for the debt to gdp ratio and the continued creation of a debt super-bubble which only now appears finally to be deflating – as Steve pointed out in

“Bailing Out the Titanic with a Thimble”, “each apparent recovery after a debt-induced crisis was really a re-ignition of the fundamentally Ponzi lending that had caused the preceding crisis” (p. 9). What must be made absolutely clear is that the worst possible outcome for the global economy is the successful facilitation of another recovery driven by restarting expansionary lending. If one thinks of how much worse this crisis has been than that in the wake of the bursting of the ‘dotcom bubble’ in the early 2000s, one should imagine that the next crisis will be worse by a similar order of magnitude, with an even higher mountain of private debt still to climb. The proportion of debt in the economy simply can’t expand indefinitely.

Most of the 99% probably don’t fully understand endogenous money or the full implications of an economy dependent on private debt expansion. But they do have an understanding that bailing out Wall Street hasn’t solved the problem and probably never will. They do understand that people can’t just keep burying themselves in ever increasing amounts of debt, and they do have an understanding that Wall Street got them into this crisis and probably isn’t the means of getting out of it. And in this, they are ahead of the bulk of the economics profession.

Lesson # 3. Bail out the people, not the banks.There was a period in the initial wake of the economic crisis where it looked as though Keynes would make a recovery in economic orthodoxy, and the term ‘stimulus package’ became part of everyday vernacular.

Given the failure of Bernanke’s pledge to get banks lending with monetary stimulus, it seems likely that the fiscal stimulus in the U.S., despite imperfections (and being far from as ambitious as it should have been), has had the greatest effect in slowing the progress of the crisis thus far (given that the level of private debt to gdp at the beginning of the recession was much higher than at the beginning of the Great Depression). Unfortunately, going back to my point about the alleged virtue of money creation for Wall Street and the sin of doing so to finance fiscal spending, Keynesian stimulus has now largely been abandoned throughout much of the world in favour of ‘austerity’ and deficit reduction. The idea that the magic of the free market will suddenly spring to life once Big Government gets out of the way has again pervaded the consciousness of policymakers.

Imposing austerity in an austere economic environment, and cutting government spending when private demand is retreating, will only serve to worsen the depth of the crisis. The European austerity programs have so far been all pain and no gain: job losses, pay cuts and reductions in services; all for zero improvement in the ability of governments to balance their budgets. No one has been made better off by their implementation: not the EU creditors who imposed them, and certainly not the people of the countries which have adopted them. Not that this will stop the economists from pressing forward: it’s rare for them to let a few facts get in the way of what they see as good theory.

This is not to say that fiscal stimulus will get the world all the way out of the crisis. As Steve has pointed out a number of times before, the private debt hole is too big, and the deleveraging necessary for a sustainable recovery will ultimately overwhelm what the government is able to do. Unfortunately, the most effective solution to the debt problem is also in many ways politically least viable (though I dare say that this is reflective more of the disconnect between the governments of representative democracies and their constituents than the genuine will of the people). It involves not a bailout of the banks paid for by tax payers, but an effective bail out of consumers funded by banks, who would naturally suffer profusely in the process. As Steve has proposed, a government mandated partial debt jubilee – involving both interest rate renegotiation and outright debt forgiveness – is the only way to turn back the clock on the level of indebtedness without feeling the full brunt of a decline in demand caused by massive deleveraging. In his address to the

Occupy Sydney rally (see the October 23 blog entry for youtube video), he made the point that “dishonourable debt should not be honoured”. Many financial organisations may go into receivership or have to be nationalised, but the debt burden which oppresses so many people would be substantially reduced, increasingly their ability to spend their hard earned money on goods and services rather than servicing or paying down debt.

The 99%’s objections to the idea of bailing out Wall Street on the one hand, while cutting spending on the poor and allowing struggling individuals to go bankrupt and lose their houses on the other, are probably for the most part based more on a sense of fairness, and the knowledge that these things aren’t good for them, than on any sense that they know of alternatives which will be more beneficial for ‘the economy’. However, in their objections alone they have for the most part shown an understanding of the nature of the problem which exceeds that of the economic experts who wish to impose such measures.

If you aren’t an economist, you may know more about economics than you think…

Economists have gone out of their way to convince people that economics is counterintuitive and best left to the experts. Greed is good, inequality doesn’t matter. We HAVE to bail out Wall Street to save the economy; we HAVE to cut services to save the economy. What the 99% show is that very often, intuition and awareness of the economic reality on the ground gives a much better understanding of economics than an education in economics. Perhaps if such concerns as they have raised had been heeded earlier, rather than been shouted down by the ‘experts’, the world would not be in the mess it’s currently in.

[1] For further discussion of these concepts, start with blog posts like

Time to Read Some Minsky,

The Roving Cavaliers of Credit, and

Bailing Out the Titanic with a Thimble, as well as the various lectures on behavioural finance. Steve’s “Debunking Economics” and Minsky’s “Stabilizing an Unstable Economy” are also obviously worth looking at.

[2] See Friedman and Schwartz, “Monetary History of the United States 1867-1960”.

[3] See Steve’s ‘Debunking Economics’ for further explanation of how conventional economists got Keynes wrong. Minsky’s ‘John Maynard Keynes’ also discusses this in some detail. See both also for a better analysis of stagflation.

[4] Median real household incomes grew, but this is only due to increased incomes for women, presumably from greater access to and participation in the paid workforce: median real incomes for males remained stagnant as for wages. See

‘Economic Report of the President’ for real wage data for nonsupervisory workers and U.S. Census Bureau Table P-5 for historical real income data.

[5] See

Economic Report of the President and the

H3 and

H6 statistical releases by the Federal Reserve.

_______________________________________________________________________

Simply brilliant.

More people need to read and learn this. Pass it on.

In a typical year, roughly 35-40 percent of households have no net federal income liability; in 2007, the figure was 37.9 percent. In 2009, however, two factors combined to cause a large, temporary spike in the share of Americans with no net federal income tax liability — the recession, which reduced many people’s incomes, and several temporary tax cuts that have now expired. The 51 percent figure reflects these temporary factors.

In a typical year, roughly 35-40 percent of households have no net federal income liability; in 2007, the figure was 37.9 percent. In 2009, however, two factors combined to cause a large, temporary spike in the share of Americans with no net federal income tax liability — the recession, which reduced many people’s incomes, and several temporary tax cuts that have now expired. The 51 percent figure reflects these temporary factors. Policymakers, pundits, and others often overlook this point. At a hearing last month, Senator Charles Grassley said, “According to the Joint Committee on Taxation, 49 percent of households are paying 100 percent of taxes coming in to the federal government.” At the same hearing, Cato Institute Senior Fellow Alan Reynolds asserted, “Poor people don’t pay taxes in this country.” Last April, referring to a Tax Policy Center estimate of households with no federal income tax liability in 2009, Fox Business host Stuart Varney said on Fox and Friends, “Yes, 47 percent of households pay not a single dime in taxes.” None of these assertions are correct. As the Tax Policy Center’s Howard Gleckman noted regarding TPC’s estimate that 47 percent of Americans owed no federal income tax in 2009, “rarely has a bit of data been so misunderstood, or so misused.” Gleckman wrote:

Policymakers, pundits, and others often overlook this point. At a hearing last month, Senator Charles Grassley said, “According to the Joint Committee on Taxation, 49 percent of households are paying 100 percent of taxes coming in to the federal government.” At the same hearing, Cato Institute Senior Fellow Alan Reynolds asserted, “Poor people don’t pay taxes in this country.” Last April, referring to a Tax Policy Center estimate of households with no federal income tax liability in 2009, Fox Business host Stuart Varney said on Fox and Friends, “Yes, 47 percent of households pay not a single dime in taxes.” None of these assertions are correct. As the Tax Policy Center’s Howard Gleckman noted regarding TPC’s estimate that 47 percent of Americans owed no federal income tax in 2009, “rarely has a bit of data been so misunderstood, or so misused.” Gleckman wrote: Low-income families also pay substantial state and local taxes. Most state and local taxes are regressive, meaning that low-income families pay a larger share of their incomes in these taxes than wealthier households do. The bottom fifth of taxpayers paid 12.3 percent of their incomes in state and local taxes in 2010, according to the Institute on Taxation and Economic Policy (ITEP) model. That was well above the 7.9 percent average rate that the top 1 percent of households paid (see Figure 3).

Low-income families also pay substantial state and local taxes. Most state and local taxes are regressive, meaning that low-income families pay a larger share of their incomes in these taxes than wealthier households do. The bottom fifth of taxpayers paid 12.3 percent of their incomes in state and local taxes in 2010, according to the Institute on Taxation and Economic Policy (ITEP) model. That was well above the 7.9 percent average rate that the top 1 percent of households paid (see Figure 3). Approximately 70 percent are working people who pay payroll taxes. As noted above, even the low-income households in this group pay substantial federal income taxes over time. The main options to force these people to pay federal income tax in years when their incomes are low include cutting the EITC or the Child Tax Credit, which would tend to reduce work incentives and increase child poverty and welfare use, and lowering the standard deduction or personal exemption, which could tax many low-income working families into, or deeper into, poverty.

Approximately 70 percent are working people who pay payroll taxes. As noted above, even the low-income households in this group pay substantial federal income taxes over time. The main options to force these people to pay federal income tax in years when their incomes are low include cutting the EITC or the Child Tax Credit, which would tend to reduce work incentives and increase child poverty and welfare use, and lowering the standard deduction or personal exemption, which could tax many low-income working families into, or deeper into, poverty.